Who MAPPed & Backed Reputable Media's 'Anti-vax Hero' Start-up Ziarco?

A 'Head in the Nimbus Cloud' Atlas Chronicle on Ex-Pharma MAPPed Startups and more than one way to skin Schrödinger's Cat. Hat /Tip to #jikkyleaks for the Tip / off Nudge.

Table of Contents

The MAPPed Ziarco

1.1 What is Pfizer’s Anti-bribery Network?

1.2 Why is there no such thing as an Ex-pharma Whistleblower?The Ex-Ziarco Misleading Skepticism

2.1 Why Fact Check the Fact Checkers?

2.2 Why did the Media need an Anti-vax Hero in late 2020?The Chronicles of Ziarco

3.1 Where does the Backing Loan lead to from 2012?

3.2 What does the Foreground Press release from 2012?

3.3 Who was Ziarco ‘Pfizer Observer’ in 2016?The ‘BVF’ Hedge Fund Manager

4.1 Why Biotica in 2005?

4.2 Why Kymera in 2020?

4.3 Why a Chicago &or Cayman Island address in 2015?The ‘BVF’ Unorthodox Philanthropist (UP)

5.1 How did Lampert-Byrd Grant from 2010?

5.2 What did Lampert-Byrd Bottom-UP from 2010?

5.3 Why Lampert’s Background?

The Penny Drops on the Nimbus Apollo Mission

6.1 Why a ‘Nimbus-like LLC Structure’ from 2009?

6.2 How did Gates-Shaw Predict their Advantage for 2020?

1. The Mapped Ziarco

1.1 What is Pfizer’s Anti-bribery Network?

Ziarco could be found listed under Pfizer’s ‘Active Portfolio Companies - View our list of current and former companies that we've partnered with’ until June 21st 2025.:

Ziarco Pharma Acquired by Novartis in 2017 Canterbury, UK

Ziarco is a clinical stage biotechnology company developing innovative therapeutics targeting inflammatory skin diseases.

To ‘protect against retaliation’ Pfizer records and analyses every transaction made by ‘colleagues’ from global service centers such as this one in Dalian China. In the ‘Summary of Pfizer’s Anti-Bribery and Anti-Corruption Policy’1 it stipulates colleagues ‘must follow’ Pfizer’s MAPP which refers to each colleagues ‘MY Anti-Corruption Policy and Procedures’.:

In Pfizer’s ‘The White Guide’2 it defines these MAPPed transactions as:

Any interaction in which a payment or other benefit may be given to a non-U.S. Healthcare Professional (HCP) (e.g., engaging the individual as a consultant).

1.2 Why is there no such thing as an Ex-pharma Whistleblower?

Arkmedic’s recent ‘The Miscarriages are Glowing’3 shows why

The problem with “ex pharma” whistleblowers is that there is no such thing.

And summarises the Ziarco founder and “ex Pharma” whistleblower’s ‘dubious’ factor here:

Because he pushes no virus rubbish and his syncytin story was perfect fodder for debunking which gave the psychos in charge the ideal excuse to push the vaccines on pregnant women. That was a deliberate set up. These fact checks were ready to go.

Indeed, Mike Yeadon, the Ziarco founder in question became the de-facto drug ‘expert’ and Key Opinion Leader (KOL) for the ‘anti-vax’ reputable media commentary providing a textbook example of how to control a dual narrative.4 In this case by seeding a ‘skeptical’ faction with scientific misinformation so the fact checkers had re-assuring scientific fodder to ‘allay our fears’ and persuade us to ‘trust the science’. Meanwhile all the real whistleblowers are shadowbanned and silenced. By extension, following the Ziarco backers should lead to the ‘Wellcome’ beneficaries of this intentionally misleading skepticism.

2. The Ex-Ziarco Misleading Skepticism

2.1 Who Fact Checks the Fact Checkers?

The Feb 2021 Reuters article in question is titled ‘Fact check: Available mRNA vaccines do not target syncytin-1, a protein vital to successful pregnancies’5 and in-turn summons a facebook post that notably failed to even archive near the time.:

Numerous posts have falsely claimed that mRNA vaccines used against COVID-19 target a protein called syncytin-1, which is needed for placental formation and successful pregnancies. Many of these posts also baselessly imply that the vaccines will make people infertile. These claims are untrue; no available mRNA vaccines target a protein called syncytin-1.

One such post (here) reads: “The mRNA vacks targets a protein called Syncitin-1 which is a protein contained in the CV spike protein complex.

This debunking narrative was omnipresent in the media at the time where all fact checkers pointed directly to Mike Yeadon’s European Medicine Authority (EMA) petition6 signed and submitted on his behalf.:

For example, Healthguard Service of Newsguard in ‘Beyond Britannica’ in April 2021 asks:

‘Does the Pfizer company’s COVID-19 vaccine contain a protein called syncytin-1 that will result in female sterilization?

THE FACTS: This claim was based on a petition to the European Medicines Agency from a doctor named Michael Yeadon, apparently the aforementioned “head of Pfizer research.” In fact, Yeadon had left the company in 2011, according to a December 2020 article by The Associated Press.

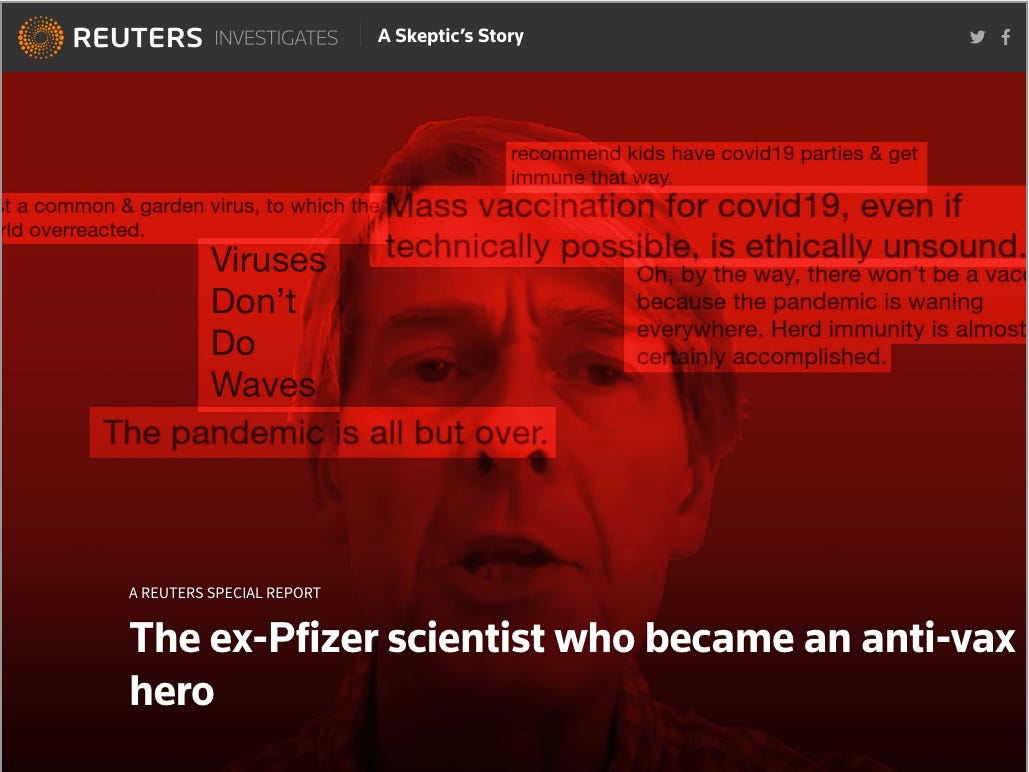

2.2 Why does the Media need an Anti-vax Hero in late 2020?

Reuters in reuters fashion had thoroughly investigated and was ready to go with ‘A Skeptic’s Story’ ‘Special Report’ by March 2021 from their Point of View (POV) of ‘The ex-Pfizer scientist who became an anti-vax hero’.7 Reuters lays the ‘debunked’ claim squarely at the petition pen of their ‘anti-vax hero’.:

Late last year, a semi-retired British scientist co-authored a petition to Europe’s medicines regulator. The petitioners made a bold demand: Halt COVID-19 vaccine clinical trials.

Even bolder was their argument for doing so: They speculated, without providing evidence, that the vaccines could cause infertility in women.

The document appeared on a German website on Dec.1. Scientists denounced the theory. Regulators weren’t swayed, either.

Social media quickly spread exaggerated claims that COVID-19 jabs cause female infertility.

If you care to read it all again, as hindsight can be so 20/20, you will see Reuters goes on to do it’s thing ‘by association’ of anyone ‘influential’ questioning the safety or efficacy of these only-provisionally-approved, poison-label-exempt, new-molecular-entities termed ‘COVID-19 mRNA vaccines.’8 A discourse enabled at the time, by the new and more inclusive definition of ‘vaccine’9 in the Meriam-Webster Dictionary to encompass the messenger RNA spike protein in January of 2021 and then pretty much any ‘immunotherapy’ by June 2021.

This anti-vax hero article also features quite a horrific social media data mining and character assassination that dually disassociates the actions from the medical establishment and wards off any real whistleblowers daring to speak out. This is weaved into an approved script on Ziarco’s origin story formed ‘After losing his job at Pfizer in 2011’ and subsequent securing of investment from the likes of Pfizer’s venture capital arm through to it’s ‘fortunate’ acquisition in 2017. The Reuters report mentions Novartis upfront payment of $325M and a further $95M for drug delivery. The ‘job loss’ was, of course, due to Pfizer’s ‘strategic’ closure of their Sandwich R&D in Kent.

As per ‘Dr. Mike Yeadon, CEO of Ziarco in Drug Development & Delivery’.:

Not only are we very fortunate at such an early stage in the company’s development to have licensed significant assets from Pfizer and secured funding from Biotechnology Venture Fund and Pfizer Venture Investments to progress development of these innovative therapeutic agents, but we have in place a highly experienced team which has deep knowledge of these programs and has the passion and expertise to deliver.

A later 2015 Biospace report, ‘Ziarco appoints Mike Grey as Executive Chairman of Board of Directors’ summarises the backers of Ziarco’s inflammatory skin disease compounds.:

Ziarco’s investors include Biotechnology Value Fund L.P. and other affiliates of BVF Partners L.P., Pfizer Venture Investments, New Enterprise Associates, Lundbeckfond Ventures and Amgen Ventures.

3. The Chronicles of Ziarco

3.1 Where does the Backing Loan lead to from 2012?

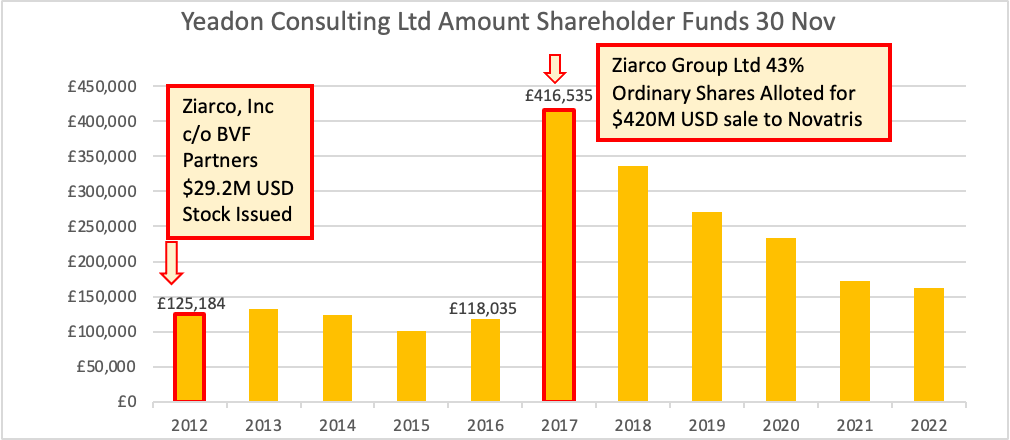

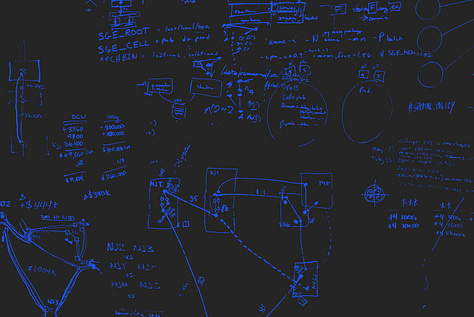

To find out more about who these investors were, due to their lack of registration in the UK’s company house, required ‘following the loan’ to Sec-dot-gov in the USA and back again. A rather painstacking record of these transactions are chronicled here.:

2011

Nov 18: Yeadon Consulting Ltd register in UK. Director Dr Mike Yeadon.

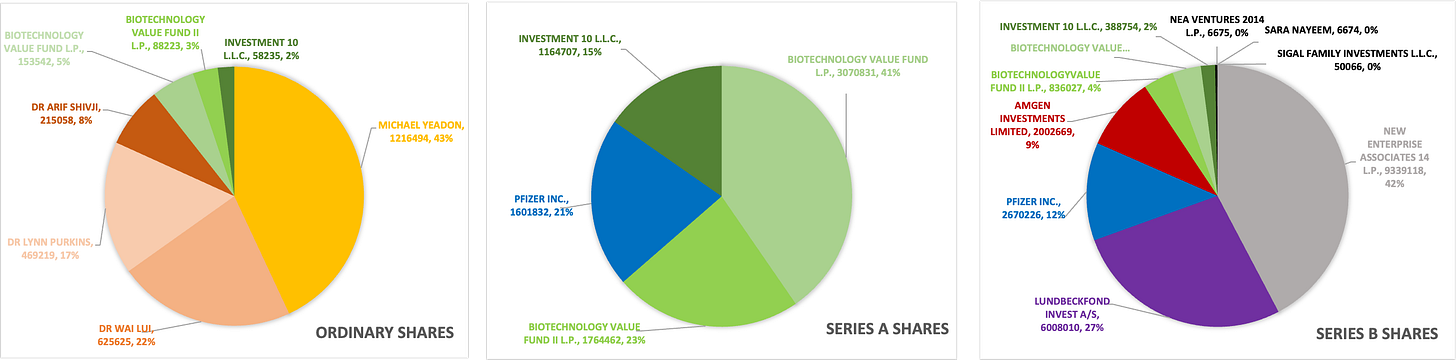

Dec 22: Ziarco Ltd register new company in UK & Appoint Directors Dr Mike Yeadon, Dr Wai Leung Liu, Dr Lynn Purkins & Dr Arif Shivji (25 Jan 2012).

2012

Sep 27: Ziarco, Inc register (5217386) as corporation & residency domestic in the State of Delaware USA.

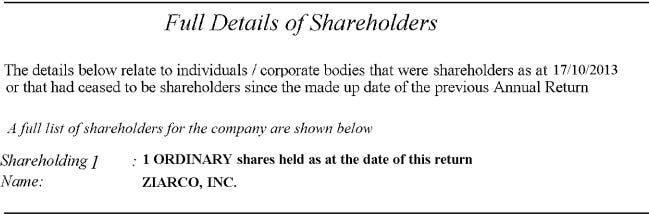

Oct 17: Ziarco Pharma Ltd register as new ‘European Economic Area Company’ in UK. Director Mike Yeadon. Shareholder (Ordinary) Ziarco Inc. Secretary Bird & Bird Ltd London.

Oct 18: Ziarco, Inc date of first Sale of Stock $7.6M USD Form D.

Oct 30: Ziarco, Inc issue (Series A) shares totalling $29.2M USD (Series A).

c/o Cooley LLP (Californian Innovation lawyers). Issurer Ziarco, Inc. Executive Officers & Directors Michael Yeadon (President & Signature) & Steve LiuWai.

c/o BVF Partners L.P. Directors Mark Lampert, Matthew Perry & Joe Sum.

Nov 30: Yeadon Consulting Ltd shareholder funds £125K (approx $180K USD).

2013

Oct 7: Ziarco Pharma Ltd appoint Directors Dr Wai Leung Liu & Dr Lynn Purkins.

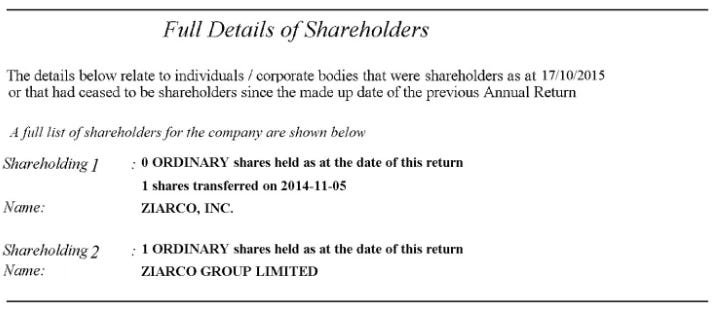

Oct 17: Ziarco Pharma Ltd list Ziarco Inc as Shareholder.

Oct 24: Ziarco Ltd apply to strike off the UK register.

Oct 31: Ziarco Pharma Ltd account Shareholder funds of £1 & receive a loan from Ziarco, Inc ‘it’s fellow subsidary undertaking’ in the USA owing £3.1M in 2014.

2014

Sep 30: Ziarco Pharma Ltd account shareholder funds of £1.2M deficit.

Oct 3: Ziarco Group Ltd register as new company Chief Executive Officer & shareholder Dr Michael Yeadon.

Oct 3: Ziarco Pharma Ltd immediate & ultimate controlling party is Ziarco Group Ltd.

Nov 5: Ziarco Pharma Ltd appoint Directors, American Mark Lampert, Edward Timothy Mathers & Swedish Carl Johan Kordel. And terminate Dr Wai Leung Liu & Dr Lynn Purkins.

Nov 5: Ziarco Pharma Ltd shareholder transfer from Ziarco Inc to Ziarco Group Ltd.

Nov 5: Ziarco Group Ltd resolution share purchase agreement and signature.:

“Investors” means Pfizer, Inc., Investment 10 LL.C., Biotechnology Value Fund, LP, Biotechnology Value Fund I, L P & Lundbeckfond Invest A/S, New Enterprise Associates 14, LP, Amgen Investments Ltd.

Company will acquire the entire issued share capital of Ziarco, Inc from the existing shareholders of Ziarco, Inc. (the "Sellers") in return for the issue to the Sellers of the same number of Ordinary Shares and Series A Shares in the Company.

Company will acquire the entire issued share capital of Ziarco Pharma Limited from Ziarco, Inc for £1.

Rights of Appointment (together with Affiliates & its Permitted Transferees) continues to hold beneficially not less than 2,000,000 Equity Shares:

"Series A Director" BVF Partners LP ("BVF")

"Ordinary Director” Lundbeckfond Invest A/S ("Lundbeckfond")& signing a non- disclosure agreement acceptable to the Company (acting reasonably):

"Series B Director" & the "NEA Observer" New Enterprises Assoc 14, L P ("NEA")

"Pfizer Observer" Pfizer Inc

”Amgen Observer” Amgen Inc

Nov 5: Ziarco Group Ltd appoint Directors Carl Johan Kordel, Edward Timothy Mathers & Mark Lampert

Nov 18: Ziarco Pharma & Ziarco Group Ltd appoint American & British Director Michael G Grey.

2015

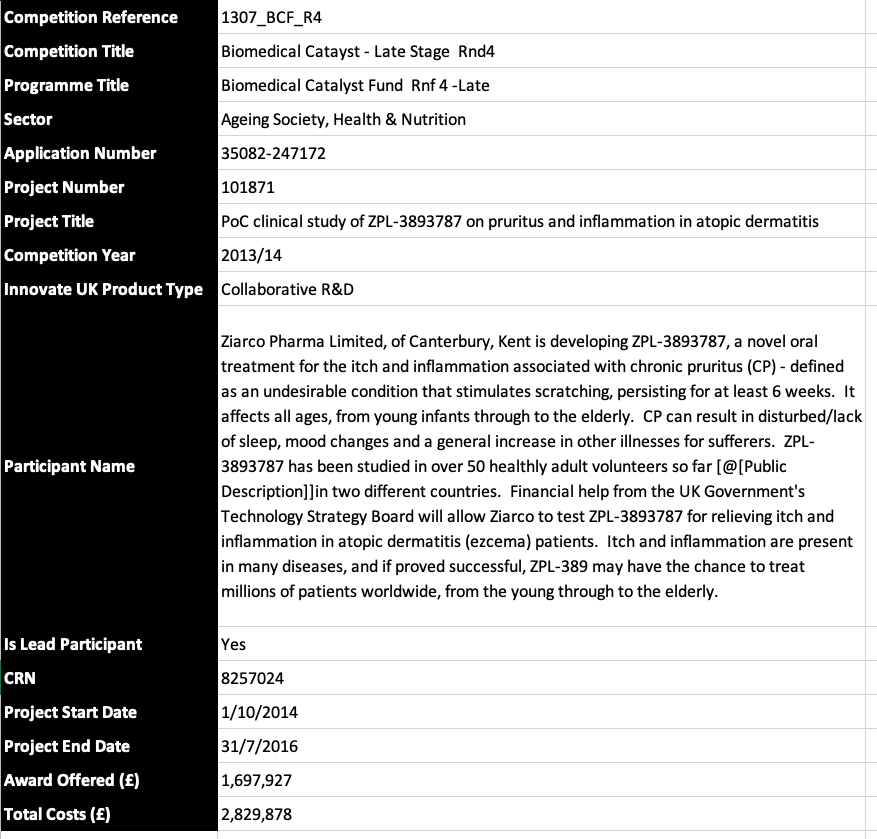

Sep 30: Ziarco Pharma Ltd account receives a UK govt grant for £1.2M (see £1.7M Innovate UK) & a loan from it’s parent undertaking Ziarco Group Ltd of £11.4M.

Oct 17: Ziarco Pharma Ltd Person with Significant Control is Ziarco Group Ltd.

2016

Jan 20: Ziarco Pharma Ltd appoint Directors Oriane Fanny Lacaze, Eric Anton Hughes & Loretto Callaghan (until 8 Mar 2017 & appoint Haseeb Ahmad).

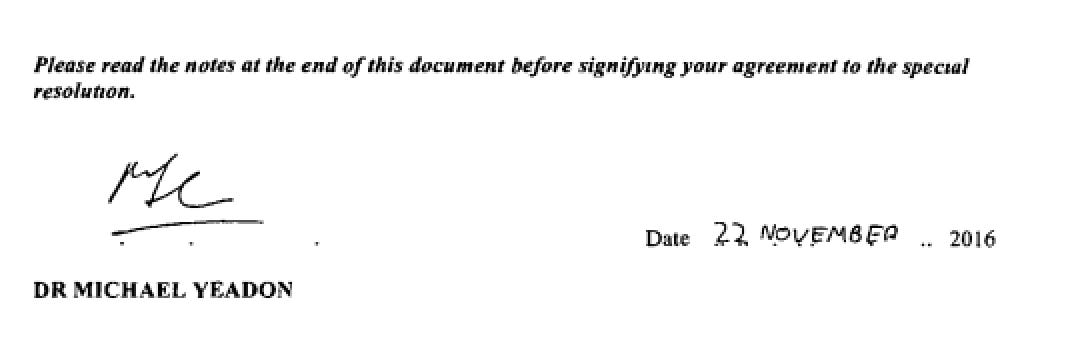

Mar 30: Ziarco Pharma Ltd: terminate Director Michael Yeadon who also resigns as CEO & Director of Ziarco Group Ltd.

Apr 6: Ziarco Group Limited becomes a Relevant Legal Entity.

Jun 20: Ziarco Group Limited allotment and subsequent confirmation of shares.

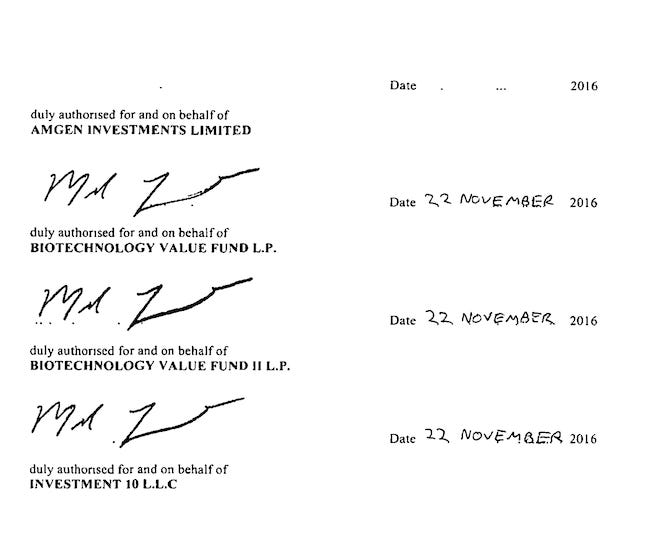

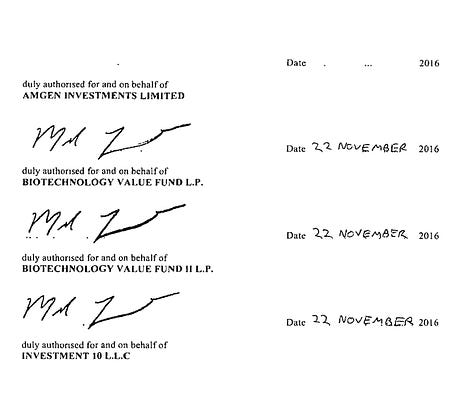

Nov 22: Ziarco Group Ltd written resolutions with Dr Mike Yeadon & Mark Lampert “BVF” signatures10

“Investors” means Pfizer, Investment 10 L LC, Biotechnology Value Fund, L P, Biotechnology Value Fund II, LP, Lundbeckfond, New Enterprise Associates 14, LP, Amgen & Sofinnova.

Directors / Observers Designated

“Ordinary Director” Michael George Grey, American & British in USA.

“BVF” “Series A Director” Mark Lampert, American Investment Manager in USA.

“Lundbeckfond” “Series B Director” Dr Carl Johan Kordel, Swedish Life Science Investor in SWEDEN.

“NEA” “Senes B Director” Edward Timothy Mathers, American Venture Capitalist in USA.

“Sofinnova” “Senes C Director” Anand Mehra [American in USA].

"Pfizer Observer” Elaine Jones [American in USA].

“Amgen Observer” Janis Naeve.

“NEA Observer” Sara Nayeem.

2017

Jan 20: Ziarco Pharma Ltd terminate Directors American Mark Lampert, Mr Edward Timothy Mathers & Mr Michael George Grey (+British) & Swedish Carl Johan Kordel.

Jan 20: Ziarco Group Ltd terminate Directors American Mark Lampert, Mr Edward Timothy Mathers & Mr Michael George Grey (+British) & Swedish Carl Johan Kordel.

Feb 27: Ziarco Pharma Ltd appoint Directors Oriane Fanny Lacaze, Eric Anton Hughes & Loretto Callaghan.

Apr 10: Ziarco Group Ltd resolution and subsequent confirmation of all shares transferred to Novartis Pharma AG ‘held 39040697 ordinary shares’.

Nov 30: Yeadon Consulting Ltd shareholder funds £298K (approx $400K USD)

3.2 What does the Foreground Press release from 2012?

In the foreground, press releases explain Ziarco’s R&D into the oral &or topical delivery of anti-allergy and anti-inflammatory dermatologic products and what was agreed to with Pfizer from their Pfizer Venture Investments (PVI) ‘via’ the “BVF” fund. Seeking Alpha notes that Pfizer licensed ZPL-389 to Ziarco back in 2012. ZPL-389 is a once daily oral histamine H4 receptor antagonist for moderate to severe atopic dermatitis. In May of 2012 Pfizer duly announced a new £3.8M research deal with UK biotech firm Ziarco on anti-inflammatory and anti-allergic medicines.:

UK-based start-up secured the funds via the Biotechnology Value Fund, which has investment from Pfizer Venture Investments.

As a result of this funding boost, Ziarco has entered into an agreement with Pfizer for the exclusive worldwide rights to commercialise a portfolio of clinical, pre-clinical and research anti-inflammatory and anti-allergic assets.

In return, Pfizer will receive equity as well as certain product-based milestone and royalty payments. Ziarco will use the proceeds of the financing to continue development of these assets and advance proprietary research, it said in a statement.

On June 14 2016 Bloomberg announces ‘pfizer backed ziarco said to mull sale in rare uk biotech deal’ and speculated that the sale could fetch over $1B and attract other drug firms. Ziarco worked with advisers at Rothschild on this sale process. By March 15 2017 Biospace was able to break the news ‘How 3 Laid Off Employees Turned Pfizer’s Discarded Compounds Into Novartis AG Gold’.:

The Ziarco deal was announced two days after Pfizer received U.S. Food and Drug Administration (FDA) approval for its atopic dermatitis drug, EUCRISA (crisaborole) ointment 2% is a non-steroidal topical phosphodieterase-4 (PDE-4) inhibitor for mild to moderate atopic dermatitis.

3.3 Who was Ziarco ‘Pfizer Observer’ in 2016?

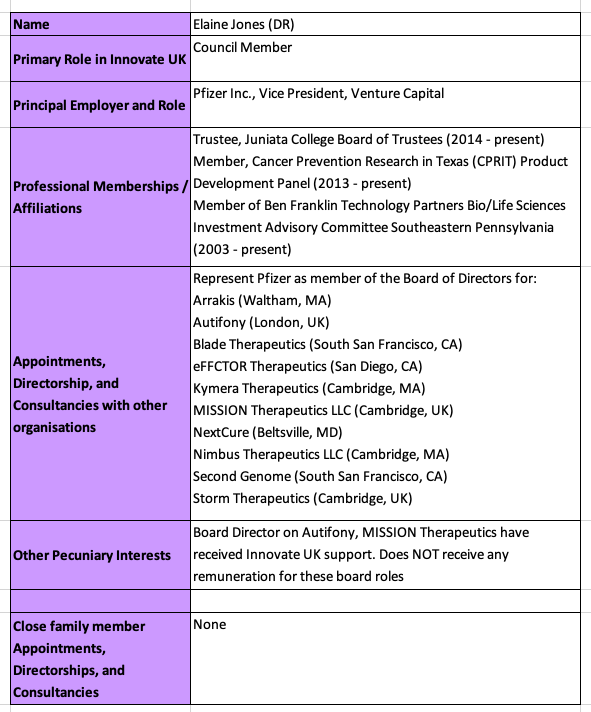

Ziarco ‘Pfizer Observer’ in 2016 was Dr Elaine Jones, V/P of Worldwide Business Development and Senior Partner at Pfizer Ventures and responsible for making and managing venture investments of strategic interest to Pfizer Inc. Dr Jones served as Pfizer Venture’s representative to the board of directors for over twenty companies from December 2008 through to April 2019 with Kymera Therapeutics being one such example as a Pfizer rep from 13 Nov 2018.

‘Innovate UK’ reports in 2014/15 that Ziarco’s Biomedical Catalyst grant was run jointly with the UK Medical Research Council and their 2016 Evaluation Process says:

Biomedical Catalyst was designed to deliver innovative life sciences products and services more quickly and effectively into healthcare.

Coincidentally, in early 2018 the same American, Dr Elaine Jones, is listed on Innovate UK’s first council formed to ‘advise and make decisions on operations as it becomes part of UK Research and Innovation’ as ‘Dr Elaine Jones, Vice President, Pfizer Ventures’. In Dr Jones statutory ‘declared interests’ Kymera is listed along with other Therapeutics such as as Nimbus in the USA & MISSION & Storm in the UK.:

Coincidentally, in the time of COVID-19, Dr Jones having retired from Pfizer Ventures joined the board at Novartis Venture Fund in 2020 and in the same year Novartis announced ‘dumping’ Ziarco’s eczema drug for a $585M ‘hit’. In 2021, back home in CAMBRIDGE, Mass. USA Myeloid Therapeutics appoints Elaine Jones, Ph.D., to its Board of Directors.:

In 2024 Dr Jones posts on social media.:

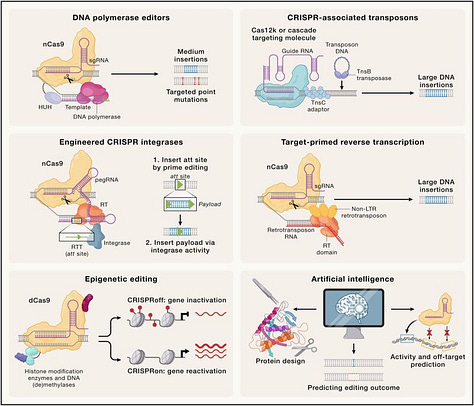

I am very proud of Myeloid Therapeutics, a company at the forefront of harnessing the power of mRNA for large-scale genome editing with their CRISPR-Enabled Autonomous Transposable Element (CREATE). This cutting-edge technology is capable of delivering multi-kilobase gene payloads with precision and selectivity. CREATE can be used across a wide spectrum of genetic diseases. Learn more here: [CREATE for RNA-based gene editing & delivery] #MyeloidTherapeutics #GeneEditing [CRISPR Therapies Move into Pediatric Care] #mRNA #HealthInnovation #Biotech

4. The ‘BVF’ Hedge Fund Manager

4.1 Why Biotica in 2005?

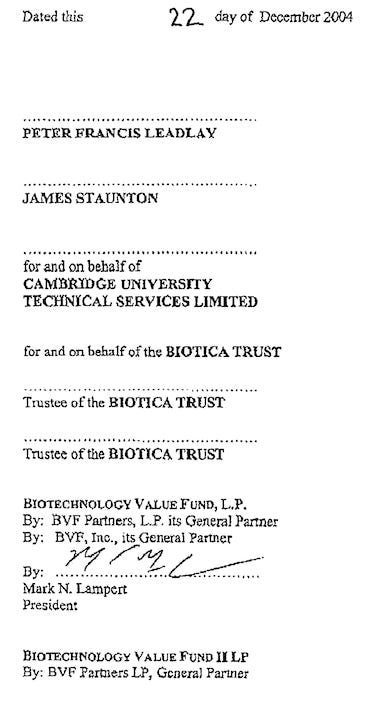

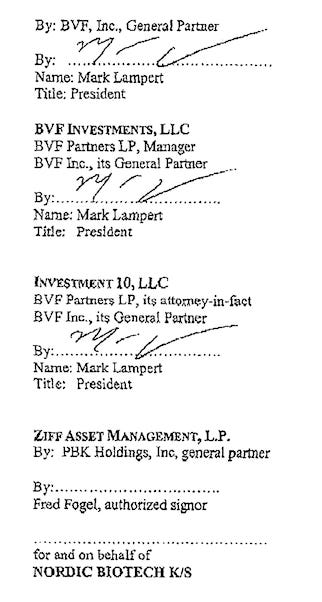

Mark Lampert, the American Investment Manager who signed for “BVF” funds for Ziarco in 2016 had a previous foray into UK Company House in 2005. In 2005 it was Mark Lampert who directed and signed similar for ‘Biotica Technology Limited’ resolution.

2005 Jan 06 Biotica Resolution of Memorandum with Mark Lampert “BVF” signatures & compared to similar for Ziarco in 2016.:

2008 Dec 19 Special Resolution with ‘GSK Group’ ‘D Preference Shares’.

2009 Dec 31 Biotica Technology Limited Full accounts with ultimate controlling party on page 17.:

BVF (together Biotechnology Value Fund LP, Biotechnology Value Fund I LP, BVF Investments LLC, Investment 10 LLC and BVF Biotica SPV L P) is the ultimate controlling party by virtue of its significant shareholding in Biotica Technology Limited.

2009 Jan 12 Biotica Press Release reports 'Biotica Strikes Significant Collaboration Deal With GlaxoSmithKline’.

2009 Jan 20 Sec-dot-gov bio for ‘Mark Lampert’ as ‘Biotechnology Value Fund, L.P.’, CAL Founder (1993) & General Partner & BVF Inc Serving Officer and Director. Current directorships, at the time, included Biotica Technology Ltd for ‘development stage drug discovery’, Acumen Pharmaceuticals for medicines & diagnostics for Alzheimer’s & Mendel Biotechnology, Inc. for plant biotech focusing on cellulosic biofeedstocks.

2010 Aug 20 Annual return with full list of shareholders incl. ‘GLAXO GROUP LTD’.

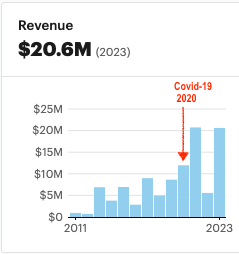

4.2 Why Kymera in 2020?

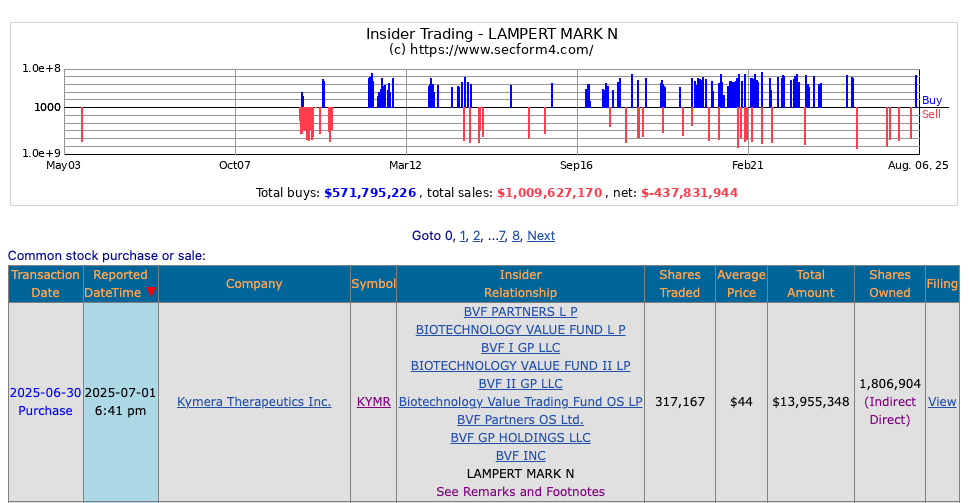

Mark Lampert’s current (2025 Aug 6) Insider Trading profile through his “BVF” partnerships has overseen over $1B USD in ‘total sales’ since 2009 from half a billion ‘total buys’. The most recent trade shown was for ‘Kymera Therapeutics Inc’ named after a Mythological Monster called Chimera.:

Kymera’s name takes inspiration from a Greek mythological creature, the Chimera, composed of several powerful animals, such as a lion’s head, goat’s body, and serpent’s tail.

[Kymera’s] small molecule medicines are heterobifunctional and use the two different “ends” to bind to two different proteins and selectively redirect the cellular machinery responsible for protein degradation.

Mark Lampert’s current ‘getowner’ lists over 50 biotech startups that includes Kymera listed as follows.:

Ownership Information LAMPERT MARK N

Kymera Therapeutics, Inc ‘Current name: Rain Oncology’.

In 2024 ‘Pathos AI’ announced that it had, through its wholly owned subsidiary WK Merger Sub, Inc. (“Merger Sub”), successfully completed its tender offer to acquire all outstanding shares of the common stock of Rain Oncology Inc.:

About Rain Oncology Inc. precision oncology company developing therapies that target oncogenic drivers to genetically select patients it believes will most likely benefit. Rain’s product candidate, milademetan, is a small molecule, oral inhibitor of the p53-MDM2 complex that reactivates p53.

About Pathos AI, Inc. clinical stage biotechnology company focused on re-engineering drug development. By leveraging the power of AI technologies, multimodal real-world data, and patient-derived biological models, Pathos brings precision medicines to market through partnership with biopharmaceutical companies. www.pathos.com.

In 2023 this Pathos tender offer was under investigation as to whether the RAIN Board of Directors acted in the best interests of RAIN shareholders in approving the sale. The 2022 RAIN Oncology web page re-iterated it’s mission as:

We focus on cancers where we can genetically identify patients most likely to benefit from treatment.

Following the chronology of Kymera explains a lot about “BVF”.:

2016 first quarter Kymera formed on a whiteboard at AtlasVenture blogged under ‘Kymera Debuts On The Public Markets’11 by founder Bruce Booth as:

‘Project Chimera’ to focus on the exciting field of ‘Targeted Protein Degradation’ (TPD). The TPD toolkit is a science-first, gold-standard platform [called] Pegasus.

2017 Oct 13 Kymera Collaboration Agreement with GlaxoSmithKline Intellectual Property Development Limited as per 2020 Aug 20 ‘Kymera Prospectus’.:

GSK’s DNA-encoded libraries, which can be used to scan trillions of compounds tagged with DNA bar codes that can be sequenced to reveal the structure of any hits to screen a number of targets.

2017 Oct 30 Kymera Press release announces Kymera’s Board of Directors as Dr. Audoly, president and CEO; Dr. Booth, chairman at Atlas Ventures; and Dr. Steve Hall, general partner at Lilly Ventures. Scientific advisors to the company include:

David Spiegel, M.D., Ph.D., Professor of Chemistry, Yale University.

Steven A. Carr, Ph.D., Senior Director of Proteomics, Broad Institute.

Michele Pagano, M.D., Chair, Dept of Biochemistry & Molecular Pharmacology, NY University School of Medicine & Investigator, Howard Hughes Medical Inst.

Ning Zheng, Ph.D., Professor of Pharmacology, University of Washington & Investigator, Howard Hughes Medical Inst.

2017 Oct 30 Atlas Ventures Partner Dr Bruce Booth and blogger of LifeSciVC tweets blog ‘Drugging The Undruggable’: Kymera’s Targeted Protein Degradation’12.:

New Atlas Venture startup coming out of stealth.

Shifted corporate structure into the ‘Nimbus-like LLC structure’, enabling a broader range of potential future deals with Pharma in a tax-efficient manner.

Two serial Atlas entrepreneurs, ex-Novartis & ex-Biogen.

Successful IPO nearly half-a-billion dollars on the balance sheet.

2018 Nov 13 Elaine Jones Ziarco’s “Pfizer Observer” was on the Kymera board representing Pfizer Venture Investments (PVI).

2019 May 9 Vertex announces Collaboration Agreement ($50M upfront) licencing and products with Kymera discovery as per 2020 Aug 20 Kymera Prospectus.

2020 Feb Negative effect of COVID-19 on Kymera’s Third-party manufacturers as per 2020 Aug 20 Kymera Prospectus.:

[Kymera] one of our vendors for active pharmaceutical ingredient, or API, starting materials based in Wuhan, China ceased its operations for several weeks due to the COVID-19 pandemic…

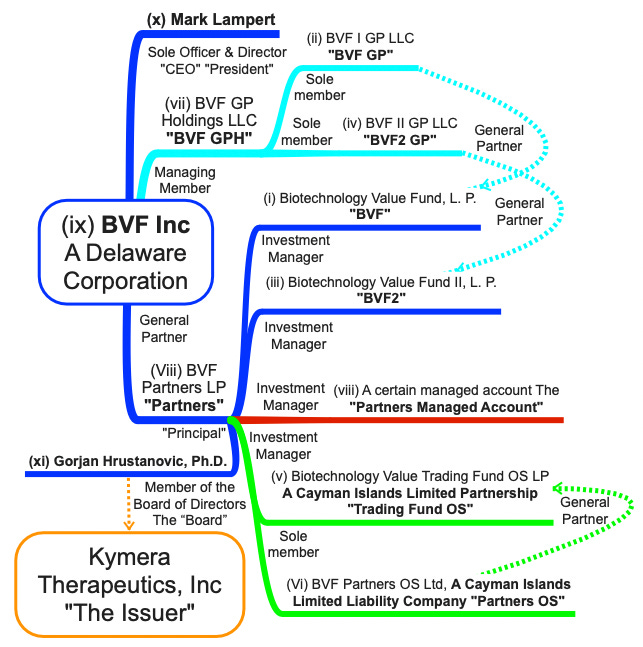

2020 Mar 1 New Kymera Director/Board Member position for BVF Partners L.P Managing Director, since 2015, Gorjan Hrustanovic, Ph.D.

2020 Mar 12 Kymera Series C Funding announced:

Some of our current investors include our founding investor Atlas Venture, as well BVF Partners,…, Vertex, and a large US-based, healthcare-focused fund.

2020 Jul 7 Sanofi Agreement, with Genzyme Corporation, or Sanofi as per 2020 Aug 20 ‘Kymera Prospectus’.

2020 Aug Kymera goes public led by Morgan Stanley, Bank of America, Cowen, & Guggenheim.

2020 Aug 20 ‘Kymera Prospectus’13 for going public and sale of D series shares.

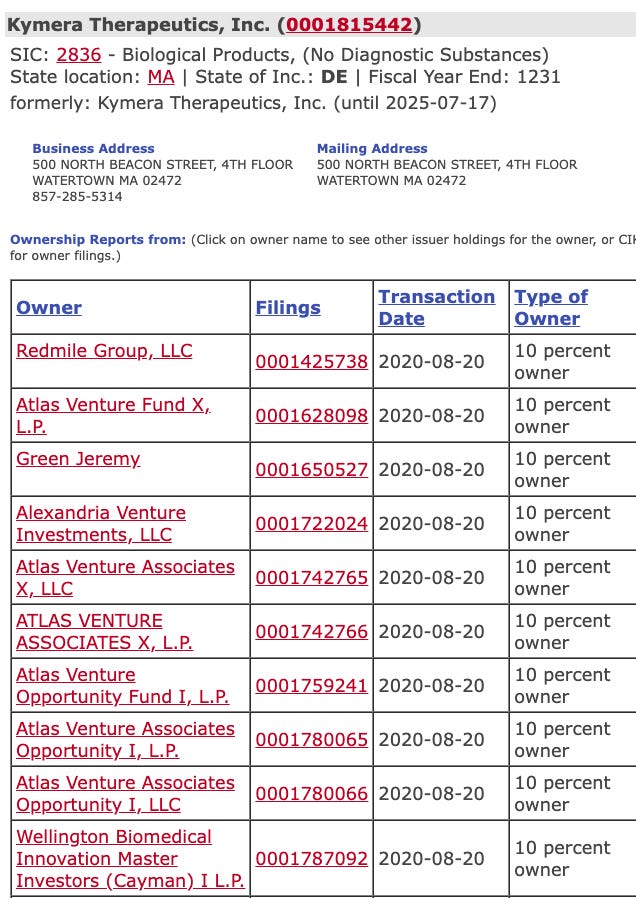

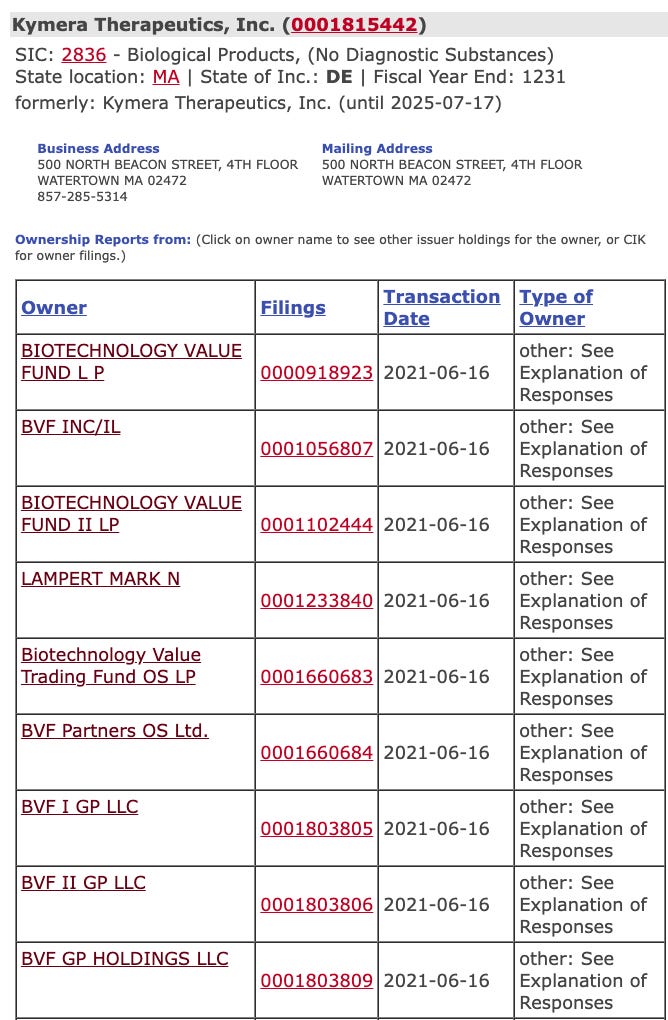

2020 Aug 20 - 2021 Jun 16 13D/13G Initial Filings Kymera Therapeutics Inc. (KYMR) Biotechnology Value Fund L P, Vertex Pharmaceuticals & Atlas Venture Fund (Dec 31)

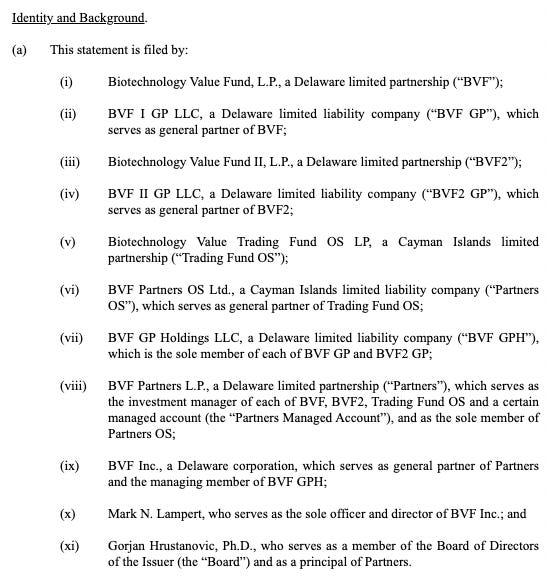

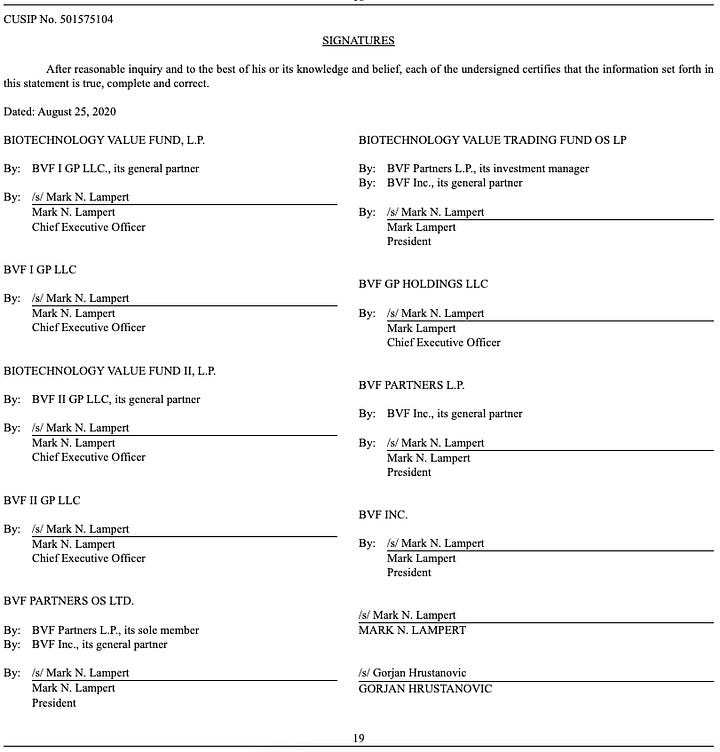

2020 Aug 21 Schedule 13D contains ‘filed by’ and ‘signature’ of “BVF” Limited Partnersip (LP) & Limited Liability Company (LLC) relationship to one another, to their Cayman Island Limited Partnership & Limited Liability Company & to BVF Inc.

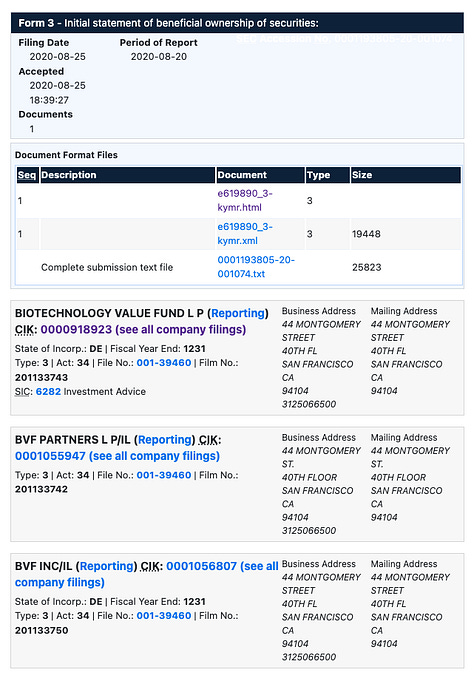

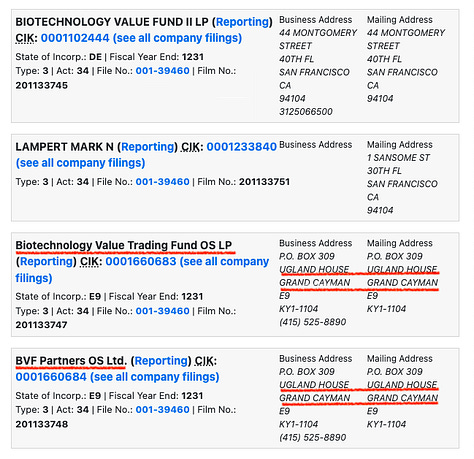

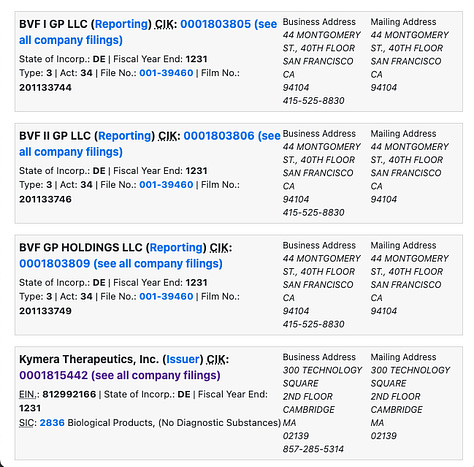

2020 Aug 25 Link to Kymera Schedule 13D (Beneficial ownership report) filed by “BVF”.

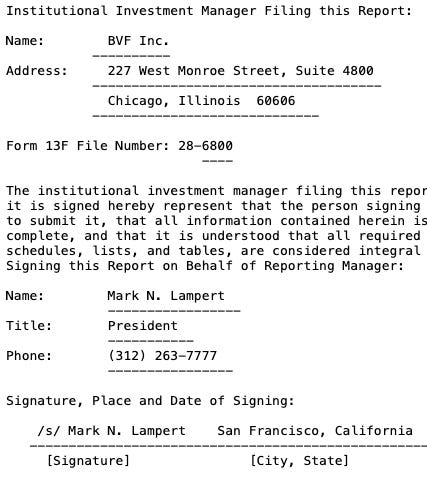

2020 Aug 25 Open Filing Form 3 (Initial insider holdings report) Initial statement of beneficial ownership of securities. Form 3 Contains “BVF” addresses including Mark Lampert in One Sansome St. San Francisco (also known as the Citigroup Center) and ‘Biotechnology Value OS & ‘BVF Partners OS’ in Ugland House, Cayman Islands.

Biotechnology Value Trading Fund OS LP & BVF Partners OS Ltd.

Business & Mailing Address:

PO Box 309, Ugland House, Grand Cayman KY1-1104, Cayman Islands

First use of BVF Partners OS Ltd in a Sec-dot-gov search is for a Benefical Owner form for ‘CTI Biopharma Corp’ dated 14 Dec 2015.

[In the 2008 US Government Accountability Office (GAO) report, Maples & Calder, a law firm & company-services provider was documented as the sole occupant of Ugland House serving as a registered office for the 18,857 entities it created as of March 2008, on behalf of a largely international clientele.]

2022 Aug 22 Kymera celebrate 2 year anniversary on Nasdaq Exchange.

2025 June 25 Gilead Sciences announce ‘Gilead Sciences and Kymera Therapeutics Enter Into Exclusive Option and License Agreement to Develop Novel Oral Molecular Glue CDK2 Degraders.

2025 Jul 1 AI generated Investing-dot-com detects a pecuniary interest ‘Kymera Therapeutics (KYMR) director group buys $13.9 million in stock’.:

Partners, BVF Inc. and Mr. Lampert may be deemed to have a pecuniary interest in the securities reported owned herein due to a certain agreement between Partners and Gorjan Hrustanovic, who serves on the Issuer’s board of directors and as a member of Partners, pursuant to which Mr. Hrustanovic is obligated to transfer the economic benefit, if any, received upon the sale of the shares issuable upon exercise of the securities reported owned herein to Partners.

4.3 Why a Chicago &or Cayman Island Address in 2015?

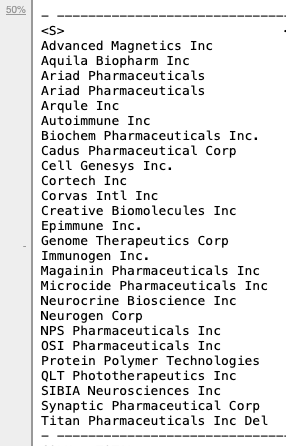

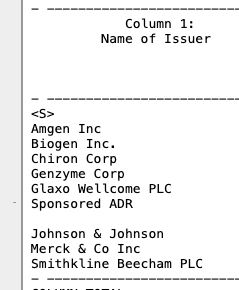

The Earliest search records for ‘BVF Inc’ on Sec-dot-gov are from 1999 with an ‘Institutional Investment Manager’ address in Chicago (60606) at 227 West Monroe St. The last 13F form of the last millenium on 31 Dec 1999 reports investments such as:

Glaxo Wellcome PLC Sponsored ADR.

[An American depositary receipt is a certificate issued by a U.S. bank that represents shares in foreign stock]

BVF “Partners” also shared this BVF “Inc” Chicago (60606) address at the time and from 2004 also list their mailing address as C/O Grosenvor Capital Management in the same Chicago (60606) postcode. Chicago ‘BVF’ addresses can be found in Sec-dot-gov upto 2015.

In 2009 President Obama referred to BVF’s “Trading Fund OS” & “Partners OS” Ugland House address in the Caymans as "the biggest tax scam in the world" and raised questions over the number of companies with a registered office in the building. In 2013, President Obama subsequently nominated Jack Lew to Treasury Secretary to rehabilitate it. This was seen as very hypocritical because it was Mr Lew who had invested heavily in funds in Ugland House while he worked as an investment banker at ‘Citigroup’ during the 2008 financial meltdown and no oversight cared!

The utter failure of this ‘rehabilitation’ re-surfaced during COVID-19 in a 2021 investigation driven by a fatal mis-carriage of justice at a Sydney Northen Beaches Australian hospital and as reported by Michael West.:

Forking out $1.2bn to build a hospital then flogging it for zero must surely make the NSW government the most hopeless dealmaker in Australian history. Then letting the buyers sell it – along with another 41 hospitals to the Cayman Islands – puts the federal government in a nearby league.

The ultimate controlling company which can be searched on public databases is the entity BCP VIG Holdings L.P. c/o Maples Corporate Services Limited, PO Box 309, Ugland House, Grand Cayman KY1-1104, Cayman Islands (ВСР).

5. The ‘BVF’ Unorthodox Philanthropist (UP)

5.1 How did Lampert-Byrd Grant from 2010?

Mark Lampert’s hypocrisy is also revealed in the COVID-19 era by simply scratching the surface of his re-directed “BVF” trades of ‘tax efficient pharma deals’ of ‘Unorthodox’ Philanthropy to his Lampert Byrd Foundation (formerly the Lampert Family Foundation). By 2017 it was well established with a network of advisors and collaborators such as the Global Development Incubator, operating out of Washington DC, to source, vet and support awardees.:

[Lampert] Sees some parallels between venture investing and philanthropy.

[GDI] launch start-ups focused on social impact & incubate partnerships to spark collective change.

In Feb 2018 their philosophy is re-iterated by the National Center for Family Philanthropy (NCFP) in Washington DC here and just before COVID-19 hit by GrantPlant here:

Hallmark program of the Lampert Byrd Foundation = Unorthodox Philanthropy (UP) unique in a bottom-UP search for interesting ideas, innovations, and solutions that are already working.

UP searches widely for rare opportunities that require a finite amount of philanthropic capital to embark on a pathway to spread widely.

It believes there are many pathways to achieve social impact at scale that don’t require building massive organizational infrastructure.

In March of 2020, true to their philosophy, Lampert pledged an inital $500K to the n-Lorem Foundation’s efforts to provide advanced, experimental RNA-targeted medicines free of charge for life to patients living with ultra-rare genetic diseases. The CEO, Dr. Crooke said:

Only 1-10 patients worldwide [but] antisense oligonucleotides (ASOs), provide an opportunity to efficiently create genetic medicines that are designed to correct certain specific genetic defects…

Adds to contributions from Ionis & Biogen.

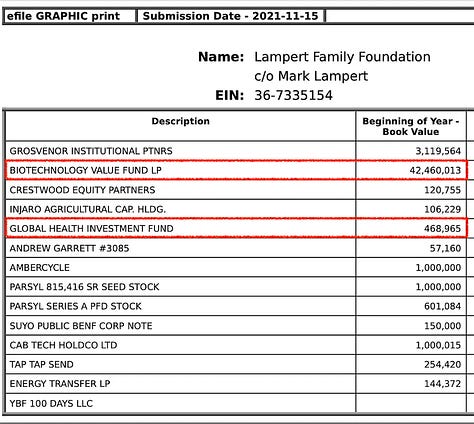

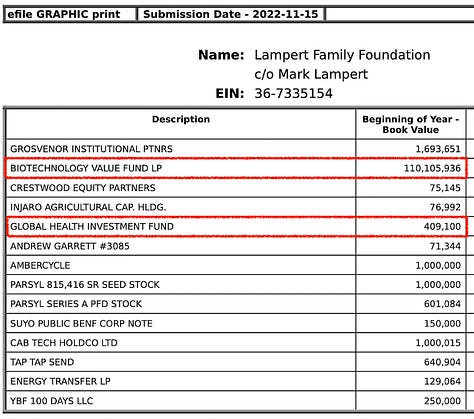

In 2021/2022 the largest reported funds on the Form 990s for the Lampert Family Foundation are from ‘Biotechnology Value Fund LP’ for $42M in 2021 and $110M in 2022. There is also $500K from the ‘Global Health Investment Fund’ which is the finance arm of ‘Global Health Investment Corporation’ (GHIC) for ‘health impact investing’. The fund's portfolio companies have successfully commercialized more than a dozen products that have been delivered to over 500M people and could be a tad more transparent.:

GHIF invested in companies developing clinical diagnostics, devices, vaccines, and therapeutics targeting diseases such as HIV/AIDS, malaria, tuberculosis, and cholera.

GHIC expanded their mission recently to include ‘global health security and pandemic preparedness’ with partners including ‘The Pfizer Foundation’, GSK and the ‘Bill & Melinda Gates Foundation’ to achieve their mission.:

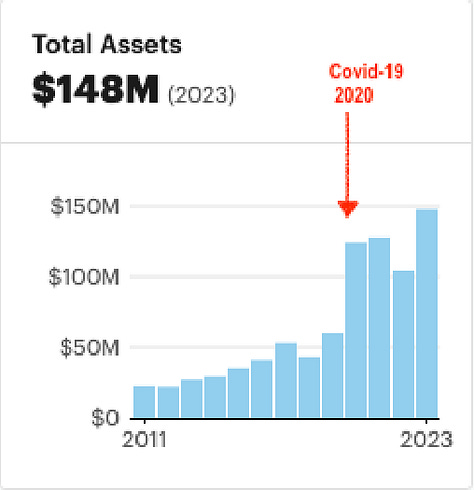

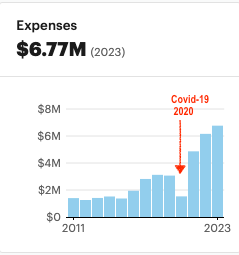

UP was overseen by Lampert from 2010 as a program of the Foundation established in 2000 by Lampert and his wife, Susan Byrd. Byrd, with a clinical social worker background, oversees Youth Opportunity Scholarships (YOS) and the Environmental Stewardship Fund (ESF) in the Bay area. Probublica chart the funds from 2011 - 2023 and CauseIQ lists the 3 grants they made in 2023 as Tides Foundation $1.7M, The San Francisco Foundation (TSFF) $500K & Boyd Group for Creative Solutions $5K and describes them as:

Primarily funds Vanguard Charitable, to support the Honduras Safer Municipalities Project [of World Bank Group], which evaluates the impact of cognitive behavior therapy on youth enrolled in a violence prevention program.

5.2 What did Lampert-Byrd Bottom-UP from 2010?

UP Programs discussed between 2010 - 2017 from the 2017 interview by the ‘NonProfit Chronicles’ with Mark Lampert are:

‘GiveDirectly’ won a $10,000+ prize Lampert crowdsourced on Innocentive to give the small nonprofit seed money on a simple goal: get money in the hands of the poor.

‘Evidence Aid’ won a Lampert prize for it’s UK-based nonprofit commitment to evidence, rigor, transparency and improving how international aid works.

’Development Media International’ (dmi) which uses advertising to promote improved health in poor countries.:

Changing behaviours. Saving lives

Runs evidence-based media campaigns to change behaviours and improve lives in low-income countries.

Conducted the first randomised controlled trial (RCT) to demonstrate that mass media can change behaviours.

‘Graduated Reintegration’, which aims to help prisoners successfully return to society.

The Crime and Justice Program, works to reduce crime and mass incarceration, and to develop sensible approaches to drug policy.

‘Strong Minds’ which is developing community-led treatments for depression in Africa.

‘myAgro’ (2018 source) a nonprofit social enterprise that enables smallholder farmers to use their mobile phones to pay on layaway for high-quality inputs (seeds, fertilizer) and agricultural training.

‘New Incentives’ which makes conditional cash transfers to encourage women to vaccinate their children and as supported by the Clinton Global Initiative and Bill & Melinda Gates Foundation at the time.:

5.3 Why Lampert’s Background?

‘Invest for Kids’ in Chicago speaker profile recognises Mark Lampert as founding donor to the Lampert-Byrd Foundation and GiveDirectly-dot-org and born and raised in Ann Arbor, Michigan. Coincidentally, Ann Arbour is the home of another ‘irrational’ closure of a Pfizer R&D facility in 2006 as reported by Forbes in ‘A Story Of Devastation And Rebirth: The Former Pfizer Research Labs In Ann Arbor’:

The long term cardiovascular outcomes study (ILLUMINATE) showed that torcetrapib didn’t reduce heart attacks and strokes in heart disease patients. Instead, torcetrapib might have even enhanced these adverse outcomes.

In 2025, GiveDirectly-dot-org is ‘Trusted by top reviewers, funders, and researchers’ from USAID to Google and the Swedish IKEA Foundation. In 2016 Harvard Business School said of GiveDirectly:

The organization doesn’t only have touching stories to tell. It also has numbers.

‘International Lifeline Fund’ in Washington DC also has a profile for Mark Lampert expanding on a career starting out at Boston Consulting Group (BCG) with a chemistry degree and an MBA from Harvard. Other roles mentioned to his ‘Hedge fund’ role at “BVF” include:

Investment banker for the firm Oppenheimer & Co.

Founder of ‘Biotechnology Royalty Corp’ which pooled biotechnology patent royalties owned by universities.

Head of Business Development for ‘Cambridge NeuroScience’.:

On Page 21 of BCG’s released 2022 ‘Annual Sustainability Report Expanding Our Reach, Enhancing Our Impact' - Bringing Pfizer’s Innovative Portfolio of Medicines to the African Union’ it outlines how they helped Pfizer.:

[Pfizer’s Problem] Half of the world’s population suffers from a health equity gap, living without access to high-quality, safe, effective medicines.

[BCG Solution]

45 lower-income countries with increased access to innovative medicines.

1.2 billion with the potential to access treatment for deadly infectious diseases.

[By] Setting up the complex program, designing the initial portfolio, geographies, options for a go-to-market model, and analyzing and securing the supply chain.

Worked on distribution, enabled sustainable prices, and conducted a regulatory analysis to initiate drug approval processes on time.

6. The Penny Drops on the Nimbus Apollo Mission

6.1 Why a Nimbus-like LLC Structure from 2009?

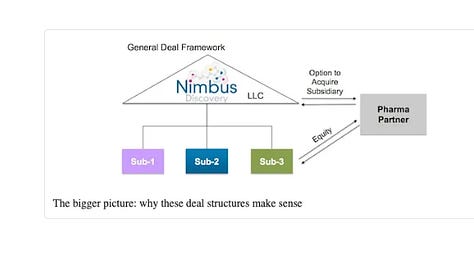

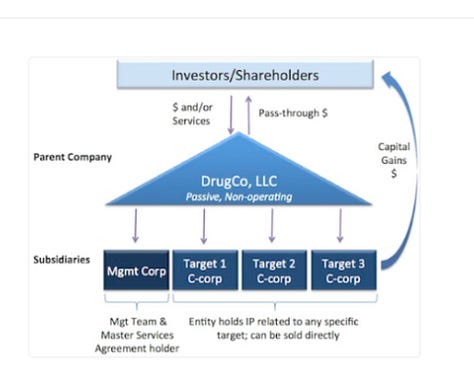

These ‘structure based drug deals’ with pharma of “BVF” through it’s ‘beneficial ownership’ of the likes of Ziarco, Biotica and Kymera therapeutics, converges on Nimbus and their Nimbus-like LLC structure described in ‘The Nimbus Experiment: Structure-Based Drug Deals’14 from 2013 that

Enables a broader range of potential future deals with Pharma in a tax-efficient manner. &

In parallel to scientific progress for initiated partnering conversations.

This has been blogged at length, by Kymeras founder and AtlasVenture Partner Bruce Booth15 at ‘LifeSciVC ‘Recovering Scientist turned early stage VC. An optimist fighting gravity’ from a Mckinsey, Oxford & Penn State University background. The Nimbus-centric posts are also cross-referenced in ‘The Book of Nimbus’16 by the Nimbus CEO. Nimbus origins are explained in LifeSciVC 2016 ‘Nimbus Delivers Its Apollo Mission: A $1.2B Gilead Partnership’17 with Ziarco’s “Pfizer observer” entering the Nimbus timeline in 2015. From other sources, Kymera enters the Nimbus timeline in 2017 and “BVF” not until 2022.:

2009 Atlas founded Nimbus with Schrödinger, a leading computational chemistry software company. At this time, Schrödinger was launching a novel computational tool called WaterMap18.

2011 Nimbus came out of stealth mode in an early LifeSciVC post called ‘Discovering Nimbus’19 when Bill Gates and Schrödinger founder Rich Friesner joined a final extension of seed round.

2015 Nimbus closed a Series B, adding Pfizer Ventures, Elaine Jones (Ziarco Pfizer Observer / Innovate UK etc) and changed name to Nimbus Therapeutics LLC.

2016 Gilead aquires, upon closing, a Nimbus subsidiary named ‘Nimbus Apollo’.

2017 Atlas Ventures brings Kymera out of stealth mode to shift to a ‘Nimbus-like LLC structure’ & an IP Collaboration Agreement with GSK for their DNA-encoded libraries (see 4.2).

2020 ‘Bill & Melinda Gates Foundation Trust’ report significant trading activity of Schrödinger Inc (SDGR) and own the most shares in early 2021.

2022 Gorjan Hrustanovic, Ph.D. Managing Director of BVF Partners L.P. appointed as Director at Nimbus adding to appointments at Kymera from 2020 & RAIN Oncology 2018 - 2024.

Etymology of Nimbus (n) 1610s, "bright cloud surrounding a divine or sacred personage," from Latin nimbus "cloud," which is perhaps related to nebula "cloud, mist" (from PIE root *nebh- "cloud").

In art, the meaning "halo around the head of a representation of a divine or sacred person" is by 1727. Figurative use is by 1860.

This ‘Nimbus Delivers Apollo Mission’ post also explains the three founding pillars of Nimbus including their ‘General Deal Framework’ called at various times ‘Nimbus-like LLC structure’ or ‘LLC therapeutics platform model’ as

A unique discovery partnership with Schrödinger;

An ultra-lean “virtually integrated, globally distributed” R&D operating model;

An asset-centric LLC holding company corporate structure enabling the sale of the eggs, not the goose.. The Golden goose [Nimbus] remains intact.

6.2 How did Gates-Shaw Predict their Advantage for 2020?

In early 2020 Forbes announced ‘Gates-Backed IPO Could Revolutionize Drug Development.’20 The company called Schrödinger Inc was also backed by hedge fund ‘legend’ David Shaw, and Forbes was certain of it’s ‘bright future’. Forbes attributed this future success to the faster, cheaper drugs and adherence to Boston Consulting Group’s ‘must embrace’ digital transformation to remain ‘competitive’ mantras. Forbes highlights Erwin Schrödinger spent the second half of his career doing biology research.

Indeed the 2020 Schrödinger Prospectus21 full of ‘visionary investors’ claimed it is far ahead of it’s nearest competitors. The advantage touted being it’s network of 150 PhD’s for predictive modelling and users located in 1,250 academic institutions and all the top 20 pharma companies as measured by sales.:

We believe that physics-based simulation is at a strategic inflection point as a result of the increased availability of massive computing power, combined with a more sophisticated understanding of models and algorithms.

Forbes does not say Schrödinger 2020 emergent predictive modelling tools are backed by a tool suite that combines quantitative and qualitative analytics developed for a risk obssessed D E Shaw Group. D E Shaw Group are also trusted for it’s portfolio management ‘discretion’ and seeking an optimal balance of risk and reward to uncover independent, hard-to-find sources of return in public and private markets.

2022 Upate ‘Summary of Pfizer’s Anti-Bribery and Anti-Corruption Policy’.

https://cdn.pfizer.com/pfizercom/MAPP_Summary_2022_Updated.pdf

2020 ‘The White Guide’ by Pfizer Inc

https://cdn.pfizer.com/pfizercom/corporate_citizenship/2020White_Guide.pdf

2021 Feb 4 World Fact check: ‘Available mRNA vaccines do not target syncytin-1, a protein vital to successful pregnancies’ By Reuters February 4, 2021 8:21 PM UTC

https://www.reuters.com/article/world/fact-check-available-mrna-vaccines-do-not-target-syncytin-1-a-protein-vital-to-idUSKBN2A42RC/

2020 Dec 6 ‘Wodarg/Yeadon EMA Petition Pfizer Trial FINAL 01DEC2020 EN unsigned with Exhibits dot pdf’

2020 Dec 1 !! URGENT !! PETITION/MOTION FOR ADMINISTRATIVE / REGULATORY ACTION REGARDING CONFIRMATION OF EFFICACY END POINTS AND USE OF DATA IN CONNECTION WITH THE FOLLOWING CLINICAL TRIAL(S)

https://web.archive.org/web/20201206010737/https://2020news.de/wp-content/uploads/2020/12/Wodarg_Yeadon_EMA_Petition_Pfizer_Trial_FINAL_01DEC2020_EN_unsigned_with_Exhibits.pdf

2021 Mar 18 ‘The ex-Pfizer scientist who became an anti-vax hero’ A REUTERS SPECIAL REPORT By STEVE STECKLOW and ANDREW MACASKILL in LONDON

Filed March 18, 2021, 11 a.m. GMT

http://www.reuters.com/investigates/special-report/health-coronavirus-vaccines-skeptic/

2021 Mar 8 An ‘In their own Words from govt sources’ Thread (Shadowbanned for 4 years) from ‘govt sources’.

https://threadreaderapp.com/thread/1368725632230649857.html

2021 Jan 18 Meriam-Webster Definition of Vaccine

https://web.archive.org/web/20210118193104/https://www.merriam-webster.com/dictionary/vaccine

: a preparation of killed microorganisms, living attenuated organisms, or living fully virulent organisms that is administered to produce or artificially increase immunity to a particular disease.

2021 Jan 26 Meriam-Webster Definition of Vaccine

https://web.archive.org/web/20210126065143/https://www.merriam-webster.com/dictionary/vaccine/

: a preparation that is administered (as by injection) to stimulate the body's immune response against a specific infectious disease:

a: an antigenic preparation of a typically inactivated or attenuated pathogenic agent (such as a bacterium or virus) or one of its components or products (such as a protein or toxin)

b: a preparation of genetic material (such as a strand of synthesized messenger RNA) that is used by the cells of the body to produce an antigenic substance (such as a fragment of virus spike protein)

2021 Jun 1 Addition to Meriam-Webster Definition of Vaccine:

https://web.archive.org/web/20210601105617/https://www.merriam-webster.com/dictionary/vaccine

2: a preparation or immunotherapy that is used to stimulate the body's immune response against noninfectious substances, agents, or diseases

2020 Aug 31st ‘Kymera Debuts On The Public Markets’

by ‘Life Sci VC’ Blogger Bruce Booth

Posted in Biotech financing, Capital markets, Exits IPOs M&As, Portfolio news

https://lifescivc.com/2020/08/kymera-debuts-on-the-public-markets/

2017 Oct 30 ‘Drugging The Undruggable: Kymera’s Targeted Protein Degradation’

by ‘Life Sci VC’ Blogger Bruce Booth

Posted in Biotech investment themes, Portfolio news, Translational research

https://lifescivc.com/2017/10/drugging-undruggable-kymeras-targeted-protein-degradation/

2020 Aug 20 ‘Kymera Prospectus’

Filed pursuant to Rule 424(b)(4) Registration No. 333-240264

by MORGAN STANLEY BofA SECURITIES COWEN GUGGENHEIM SECURITIES

https://www.sec.gov/Archives/edgar/data/1815442/000119312520227121/d940105d424b4.htm

2013 Jun 27 ‘The Nimbus Experiment: Structure-Based Drug Deals’

by ‘Life Sci VC’ Blogger Bruce Booth

in Atlas Venture, Biotech startup advice, New business models, Pharma industry

https://lifescivc.com/2013/06/the-nimbus-experiment-structure-based-drug-deals/

The ‘Nimbus-like LLC structure’

2025 About Bruce Booth

by ‘Life Sci VC’ Blogger Bruce Booth

https://lifescivc.com/about/

Early stage venture capitalist at Atlas Ventures. Focus on seed-led venture creation around the discovery and development of novel therapeutics.

Investor with Caxton Health Holdings.

Consultant at McKinsey & Company to address R&D commercialization & business development.

Advisor to Takeda, UCB, and the Gates Foundation.

Board of the National Venture Capital Association and the Penn State Research Foundation.

British Marshall Scholar D.Phil. (Ph.D.) in molecular immunology from Oxford University, focused on the study of HIV and tumor immune responses.

Penn State Biochemistry undergraduate and alumnus.

2023 Apr 27 ‘The Book of Nimbus - Chapter 1 – An Unreasonable Idea’

by Jeb Keiper, in Drug discovery, From The Trenches, Leadership, Portfolio news, Strategy

CEO of Nimbus Therapeutics, as part of the ‘From The Trenches’ feature of LifeSciVC

https://lifescivc.com/2023/04/the-book-of-nimbus/

Design a molecule on a computer.

Make the molecule at a CRO.

Test the molecule in a proprietary bespoke biological screening cascade for the target.

Analyze the resulting data, to feed the design phase of the next iteration.

2016 Apr 4 ‘Nimbus Delivers Its Apollo Mission: A $1.2B Gilead Partnership’

by ‘Life Sci VC’ Blogger Bruce Booth

posted in Atlas Venture, Exits IPOs M&As, Portfolio news

https://lifescivc.com/2016/04/nimbus-delivers-apollo-mission-1-2b-gilead-partnership/

2011 Watermap. A new paradigm in ligand optimization by

https://www.schrodinger.com/WaterMap.php

2011 Discovering Nimbus.

by ‘Life Sci VC’ Blogger Bruce Booth

Posted in New business models, Portfolio news

2020 Apr 30 Gates-Backed IPO Could Revolutionize Drug Development

By Jon Markman, Contributor. Forbes.

Analyzing tech stocks through the prism of cultural change.

https://www.forbes.com/sites/jonmarkman/2020/04/30/gates-backed-ipo-could-revolutionize-drug-development/

2020 Feb 5 Schrödinger Inc Prospectus Common Stock

Filed Pursuant to Rule 424(b)(4) Registration No. 333-235890

MORGAN STANLEY BofA SECURITIES JEFFERIES BMO CAPITAL MARKETS

https://www.sec.gov/Archives/edgar/data/1490978/000119312520026787/d766269d424b4.htm